Homeowners Insurance in and around Torrington

A good neighbor helps you insure your home with State Farm.

The key to great homeowners insurance.

Would you like to create a personalized homeowners quote?

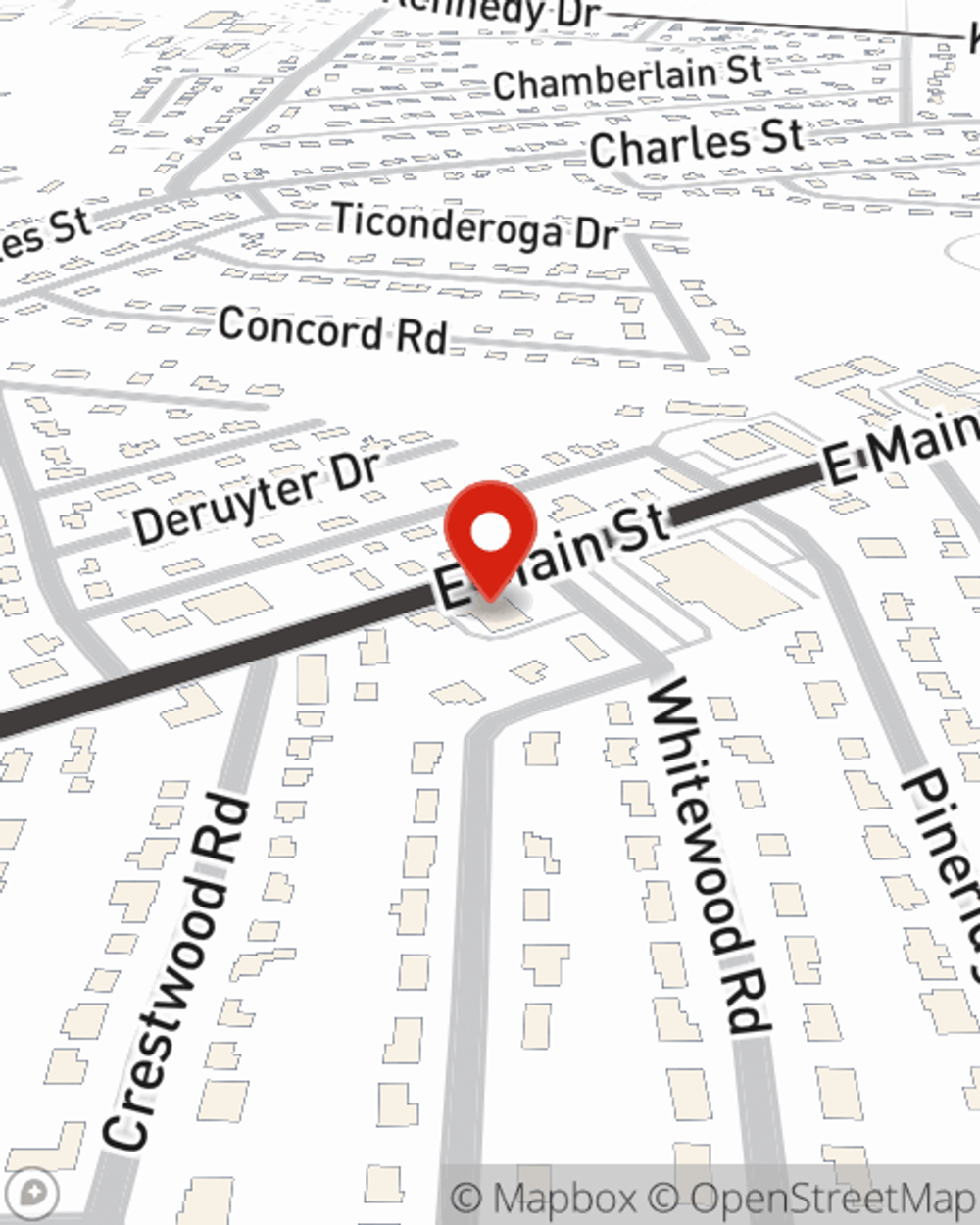

- Torrington

- Bristol

- Waterbury

- Meriden

- Hartford

- Winsted

- Harwinton

- Litchfield

- Burlington

- Farmington

With State Farm's Insurance, You Are Home

Your house isn't a home unless you're protected with State Farm's homeowners insurance. This great, secure homeowners insurance will help you protect what you value most.

A good neighbor helps you insure your home with State Farm.

The key to great homeowners insurance.

Agent Jeromy Comandini, At Your Service

You’ll get that and more with State Farm homeowner’s insurance. State Farm has coverage options to keep your home and everything in it safe. You’ll get a policy that’s personalized to accommodate your specific needs. Luckily you won’t have to figure that out on your own. With deep commitment and fantastic customer service, Agent Jeromy Comandini can walk you through every step to set you up with a plan that protects your home and everything you’ve invested in.

Don't let your homeowners insurance go over your head, especially when the accidental takes place. State Farm can bear the load of helping you get the home coverage you need. And if that's not enough, bundle and save could be the crown molding to your coverage options. Contact Jeromy Comandini today for more information!

Have More Questions About Homeowners Insurance?

Call Jeromy at (860) 489-4882 or visit our FAQ page.

Protect your place from electrical fires

State Farm and Ting* can help you prevent electrical fires before they happen - for free.

Ting program only available to eligible State Farm Non-Tenant Homeowner policyholders

Explore Ting*The State Farm Ting program is currently unavailable in AK, DE, NC, SD and WY

Simple Insights®

Home inspection: What's included and not?

Home inspection: What's included and not?

Consider a professional home inspection to help identify any immediate or potential issues before signing the papers on a new house.

How to use public Wi-Fi safely

How to use public Wi-Fi safely

When using a public Wi-Fi access there can be risks involved. We’ve provided some steps to help protect your information.

Jeromy Comandini

State Farm® Insurance AgentSimple Insights®

Home inspection: What's included and not?

Home inspection: What's included and not?

Consider a professional home inspection to help identify any immediate or potential issues before signing the papers on a new house.

How to use public Wi-Fi safely

How to use public Wi-Fi safely

When using a public Wi-Fi access there can be risks involved. We’ve provided some steps to help protect your information.